As the industry heads into the Taipei Cycle end of Q1, the outlook is still tough. Is it getting too tough? At least one commentator thinks so. In other news motors are becoming more powerful, e-bikes are rapidly not looking like e-bikes while becoming smarter and more customizable.

Contents

Is the Bike Industry Worth It?

The accelerating pace of brand implosion over the last two years has meant the forcible termination of participation in the bicycle industry by many entrepreneurs and other bike industry professionals. Everyone jumped on the e-bike opportunity who could, as well as many who actually couldn’t but tried anyway.

This has led industry veteran Jayu Yang, to question whether the bike industry is a “smart” investment any more and goes so far to suggest investing in gold as a possibly better alternative, safer at least.

Yang argues that the bike industry suffers from a double whammy of high risk and low-growth. If you survive the entrepreneurial high wire then thin margins and high uncertainty await you down the track. “The bike industry’s future isn’t certain, but it’s clear: only the resilient will ride it out” says Yang.

The two essential ingredients, then, are passion and resilience. Of the two, passion is probably the key. An abiding, deep commitment and belief in what you are doing, a commitment that serves a higher goal than just making money, serves as the base that will sustain you, give you the resilience you need to get a new venture onto stable ground.

So, there’s a perspective for startups: you’ll probably only succeed because you can’t imagine doing anything else and don’t care whether you get paid well for it or not.

Trends

Smaller motors with increasingly powerful output having the object of making an e-bike not look like an e-bike is a clear trend. The end game will be for the total absorption of electrical components into stylish (and/or aerodynamic) frames. In the meantime, power for the sake of power is the aim.

We are publishing this on the eve of the 2025 edition of Taipei Cycle and expect to see a degree of innovation incorporating these trends.

Increasing Power

Optibike has introduced the Powerstorm HT Class 1 mid-drive motor with an almost scary 190Nm of torque.

Note the shape: compact—and circular. Larger mid-drive models require elongated brackets making concealment harder. A small, circular motor can be slowed in an even only moderately beefy BB.

The rationale is that it gets riders up hills quicker and allow heavier riders to keep up with lighter riders on lower torque e-bikes.

You would think that a190Nm motor would be perfect for e-cargo, where higher torque means greater ease of moving heavy loads. We’re not at 190 yet. 110 Nm, yes.

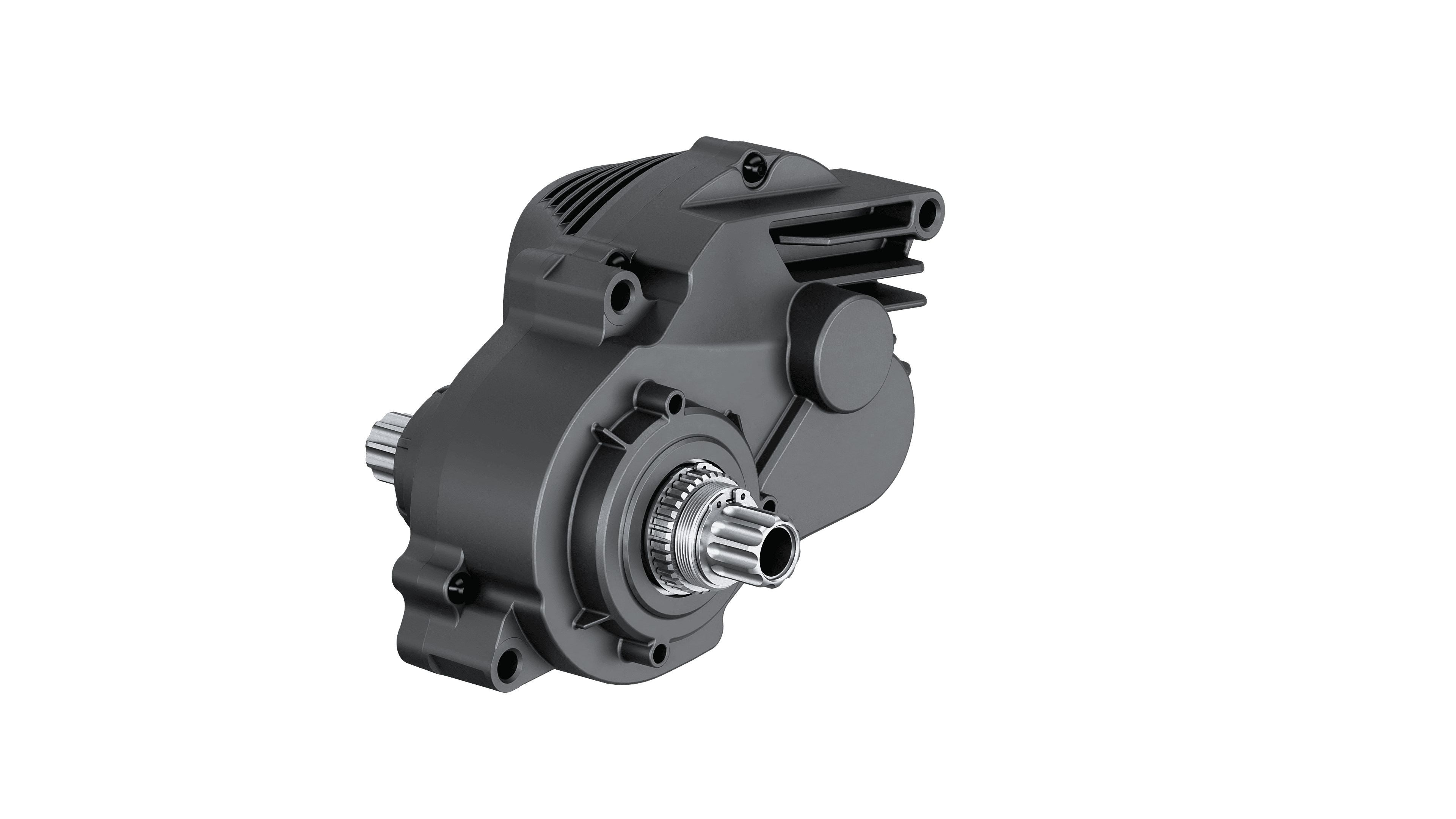

PREETO, a brand of ZW Drive GmbH and a German subsidiary of Shenzhen ZHAOWEI Machinery & Electronics Co., Ltd. has introduced a 110Nm mid-drive for cargo bikes, which takes aim at the Bosch ecosystem.

A chunky unit, yet as it’s designed for cargo bikes, the key aim is not seamless good looks, just plenty of oomph to move stuff over that last mile. Users aren’t locked into an ecosystem either: the motor can be configured to use 3rd party batteries and display/HMI products.

Even More Power?

No says the UK, in line with the EU standard of a top output of 250W and 15.5 mph limit. The proposal to allow 500W power output has been opposed by community groups. That’s going to be a relief for manufacturers by incentivizing them to focus on consolidation existing technology rather than engage in a race to see who can win the race to come up with the most powerful kit. For that to remain a niche pursuit—ie. for cargo bikes—is probably a good thing.

Making E-Bikes not look like E-bikes

In 1995 the first mobile phones looked like bricks and were almost as heavy. By 2001 you could fold and stow them in the change pocket of denim strides. Phones turned into the electronic equivalent of the Swiss army knife enslaving a good chunk of the world’s population as the device became the pre-eminent content delivery gadget.

E-bikes, though, need to cease to look like e-bikes as they follow a similar trajectory, at least in the imaginations of several ‘visionaries’ launching their start ups.

Perfect examples of the trend towards e-bike ‘normalization’, we could perhaps call the process, include Biomega’s BER.

Another is Urtopia’s Titanium Zero tagged as the lightest titanium e-bike with the most powerful motor.

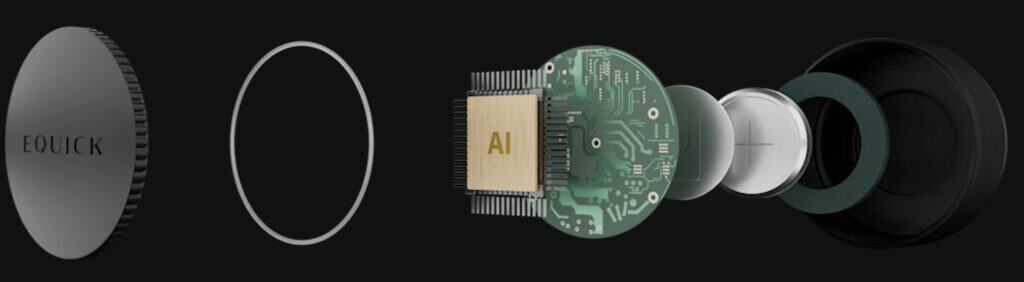

Equick is a new brand set to launch at this year’s Taipei Cycle.

The basic spec includes a lightweight frame, front hub motor, gates belt drive, and 80km battery range. The application of deformation tubes for shock absorption is a puzzle though.

Intelligent shifting is delivered through the “AI” motor where gears change automatically depending on the terrain. And yes, the bike is reportedly designed for both commuting and off-road riding hence the application of smart electronics to manage gear selection depending on the road or train condition.

The Equick is not a unique take on this vision, in particular the idea of hub drive and battery existing in the same space. Gogoro’s Eeyo pioneered the battery/hub motor some years ago. Their attractive, lightweight all-carbon fiber design was ahead of its time and its failure to capture the market may have been a function of their business model as much as anything. Equick envisages being able to deliver semi-customizable bikes through their dealer network.

Delta Electronics, chosen by Taiwan’s government to produce an all-Taiwan-made mid-drive motor, relate that their design philosophy is aimed at producing an e-bike that’s indistinguishable from any other. A lot of big name brands are looking to adopt the motor and accompanying HMI system (official launch at Taipei Cycle 2025) at the movement towards sleek and svelte units accelerates.

Smart, Customizable, Light

It remains to be seen to what extent Equick’s “AI” motor contributes to a truly intelligent design. But the trend towards “smart” e-bikes is gathering pace, so the brands offering them would argue at any rate. Ultimately the job is to come up with a product that makes a consumer’s life easier. ‘Pleasure’ and ‘joy’ are fine. But customers pay for convenience.

Mahle’s X30 and XS systems have received recognition at the 2025 Design and Innovation Awards (the Mahle X20 won in 2023). Although winning awards is no guarantee of commercial viability, the mix of ingredients certainly adds value to the e-bike experience. The elements which a top-notch intelligent system comes down to being lightweight and simple . . . and not appearing to be an e-bike.

At first glance at Le Velo Studio approach to e-bike design you might be inclined to think Rivendell and they may well have taken inspiration from the latter’s modern classic style. The goal is to deliver an e-bike that’s light and almost cannot be mistaken for an e-bike.

12.3kg is not the lightest per se although certainly sits amongst that top group of the lightest models on the market as of Q1. Not ‘smart’ in the high-tec sense, but smart/attractive.

If smart is your thing then the Flitedeck smart handlebar may be just up your alley. Online speculation has reached fever-pitch as the product is getting ready to launch.

The WiFi and E-sim-enabled carbon fiber handle bar houses a 180x70mm IP68 waterproof touchscreen cycling computer with GPS navigation, fitness connectivity, security features, crash detection, lighting controls, plus a number of training modes. It will integrate with all standard cycling sensors (power meter, heart rate monitors and the like).

One of the co-founders cites their puzzlement at why the bike industry hadn’t come up with something like this before. Well, you can’t help but think this super-gadget has all the hallmarks of technological overkill. The premium retail price at around USD 1,600 designates it luxury kit aimed at those who love their tech laid on thick. Are there enough cycling enthusiasts to keep Flitedeck afloat in a world where cycling is an antidote to the tyranny of gadgets over modern lifestyles? We’ll wait and see.

Let’s finish off this section with one that doesn’t fit at all, the “omnidirectional” e-bike which has rigid spheres (called “walking globes”) in place of wheels enabling movement in any direction. The—let’s call it OEB—is constructed from 4040 T-sot aluminum and customized 3D printed parts. Four motors control direction and balance with a fifth powering forward and reverse motion.

A cumbersome early version that is bound to attract plenty of sceptics, there is at the least potential for niche applications in disabled or aged care for example.

Battery Developments

China has emerged as way ahead of everyone else in battery tech since the main way of getting around is by pedelec and has been that way for decades.

Lithium is the key ingredient in modern batteries (Lithium or Lithium-ion batteries). But the chemical is unstable unless contained in a strictly controlled environment, which has led to the seemingly daily occurrence of battery fires—that and products that don’t meet safety standards. The ancient technology of Sealed Lead Acid (SLA) is making a comeback for this reason.

The Chinese government is promoting a shift to a particular type of SLA, the Absorbed Glass Mat (AGM) type where a glass fiber separator is inserted between the positive and negative plates to absorb acid.

But while being safer, this older technology doesn’t have the energy density and efficiency of lithium-based batteries. Nor do they last as long, all the reasons they became obsolete in the first place.

Sodium-Ion may the solution and the next big innovation since it combines the safety of SLA with a higher energy density and longer life span. Sodium-Ion vs Lithium-Ion, although it seems that SI is better used for energy storage rather than for the deployment of energy for immediate use.

E-Cargo and E-Commerce

At FIRST Components we get a lot of projects from e-cargo brands for the design of custom headsets, particularly in respect of the second headset in the steering components in front of the cargo bin. In short, the cargo bike sector is one of the most dynamic and rapidly developing sector in the industry right next to another relentlessly expanding sector—e-commerce. In the USA Q1 2024 was around 2% higher than Q4 of 2023. And that’s saying something since Q4 sees the biggest consumer expenditure across the holiday season.

Looking ahead to 2029 e-commerce CAGR is expected to be in the order of 11.8% reaching a valuation of $3 billion from 2025’s expected valuation of around $2.1 billion. You might have expected the e-commerce connection given the link between cargo bikes and last mile delivery in the supply chain.

The link is fortuitous, a bit like the opportunists who made picks and shovels to gold miners available during gold rushes. E-commerce is saturated, fiercely competitive; great success is elusive. Supplying part of the infrastructure for selling products online is how Amazon became the monster it is, not the mere fact of selling products. Now it seems e-cargo bikes are riding the wave. 21% of retail purchases will be carried out online in 2025 rising to 22.6% in 2027 enabling a straight forward prediction of a continued relentless rise in the e-cargo bike opportunity. Well, before that too becomes saturated.